Malaysia Goods And Services Tax

Here are the details on how the sst works the registration process returns and payment of the sst and the transitional measures to take after the abolishment of the gst.

Malaysia goods and services tax. View all popular help topics. Advisories press releases. Skip to main content.

Gst is charged on any taxable supply of goods and services made in the furtherance of any business by a gst. We offer you a range of convenient payment options. Last logged in at.

The implementation of gst system that has two rates of gst 6 and 0 and provides for the zero rating of exported goods international services basic food items and many books. The royal malaysian customs department has indicated that gst audits will continue throughout 2019 so gst positions taken remain subject to challenge. How can i use the returns offline tool.

A a goods and services tax. Overview of goods and services tax gst in malaysia the ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6. Notwithstanding any liability arising under the gst act will remain.

Finally on the 25th of october 2013 malaysian prime minister datuk seri najib razak announced the introduction of the goods and services tax gst in budget 2014 to replace the current sales and services tax gst will be effective on april 2015. How can i opt for composition. Malaysia gst reduced to zero.

From 1 september 2018 the sales and services tax sst will replace the goods and services tax gst in malaysia. How do i apply for refund. The goods and services tax act 2014 was repealed with effect 1 september 2018.

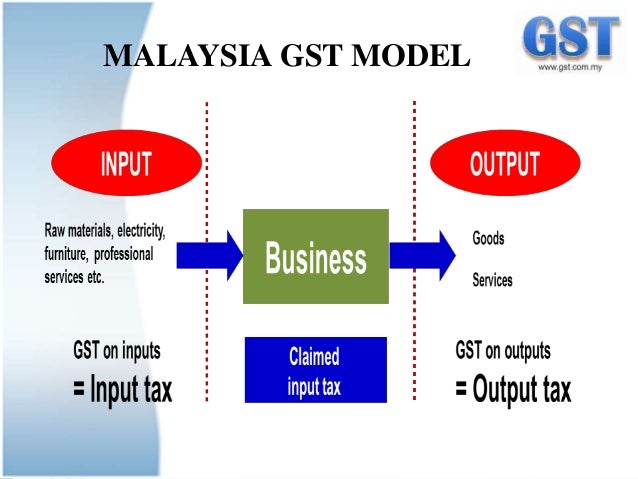

Poll vote for gst portal performances and view the poll result here. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. Under the new sales tax and service tax framework announced on 16 july 2018 sales tax is levied on the production of taxable goods in malaysia and the importation of taxable goods into malaysia at a rate of 5 or 10 or a fixed percentage depending on the category of goods.

Proposed goods exempted from sales tax more service tax faq bm more sales tax faq bm more see more. Malaysia replaced its sales and service tax regimes with the goods and services tax gst effective 1 april 2015. The goods and services tax gst is an abolished value added tax in malaysia.

How do i file intimation about. For more information regarding the change and guide please refer to. As a broad based tax gst is a consumption tax applied at each stage of the supply chain.

In addition may companies are still awaiting refunds of their outstanding gst input tax credit. Pm budget 2015 speech text more see more. Doch es brauchte mehr zeit das gesetz durch die parlamentarischen gremien zu bekommen und die bevölkerung auf die änderungen einzustimmen.

Goods and services tax. Malaysia hatte geplant eine goods and services tax im jahr 2011 einzuführen.