Malaysia Personal Income Tax Rate

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

Malaysia personal income tax rate. On the first 5 000 next 15 000. Income from rm50 000 01. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

For example let s say your annual taxable income is rm48 000. What is a tax deduction. What is chargeable income.

Income from rm35 000 01. Income from rm20 000 01. The personal income tax rate in malaysia stands at 30 percent.

However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Income tax rates 2020 malaysia. Malaysia personal income tax guide for 2020.

Malaysia residents income tax tables in 2019. What is a tax exemption. Here are the income tax rates for personal income tax in malaysia for ya 2019.

Income from rm70 000 01. There are no local taxes on personal income in malaysia. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Income tax rates and thresholds annual tax rate taxable income threshold. On the first 2 500.

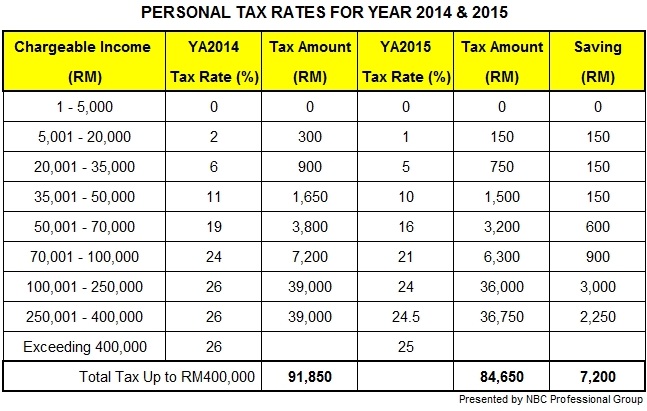

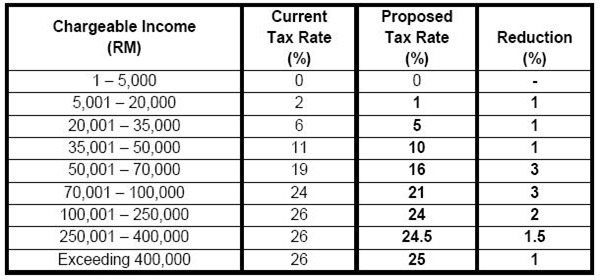

Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. What is tax rebate. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020.

The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Malaysia personal income tax rate. Income from rm5 000 01.

It was proposed in april 2011 that an approved resident individual under the returning expert programme having or exercising employment with a person in malaysia would also enjoy a tax rate of 15 for five years. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.