Malaysian Income Tax Act 1967

Generally income taxable under the income tax act 1967 ita 1967 is income derived from malaysia such as business or employment income.

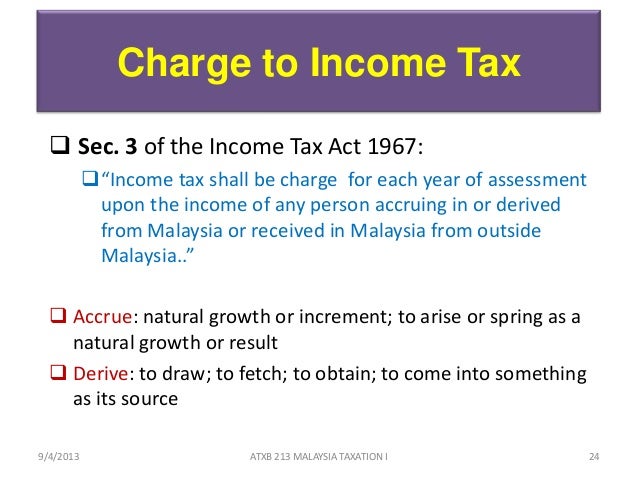

Malaysian income tax act 1967. Interpretation part ii imposition and general characteristics of the tax 3. Under the income tax act 1967 a malaysian tax resident company and a unit trust are not taxed on their foreign sourced income regardless of whether such income is received in malaysia. 2020 07 02 16 57 43 ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran.

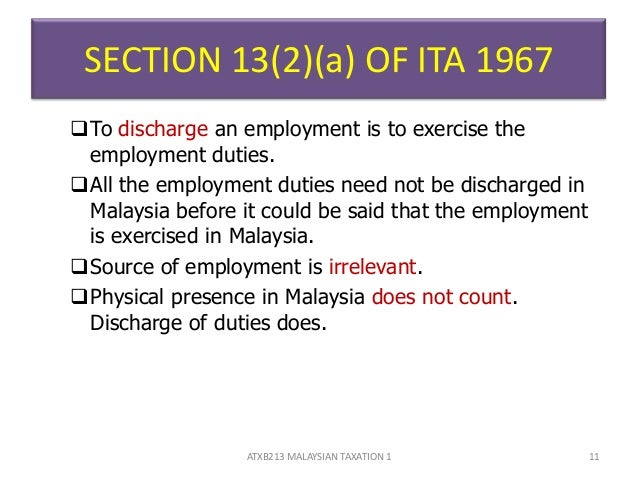

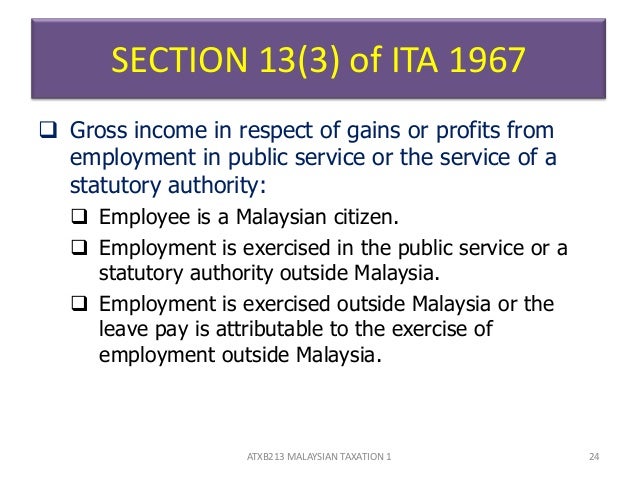

The income tax act 1967 malay. Charge of income tax 3 a. This is because that income is not derived from the exercising of employment in malaysia.

28 september 1967 be it enacted by the seri paduka baginda yang di pertuan. Fractions of twenty shillings. Charge and deduction of.

Non chargeability to tax in respect of offshore business activity 3 c. 1 for the purposes of this act an individual is resident in malaysia for the basis year for a particular year of assessment if. Short title and commencement 2.

Therefore income received from employment exercised in singapore is not liable to tax in malaysia. However income of a resident company from the business of air sea transport banking or insurance is assessable on a worldwide basis. Foreign account tax compliance act fatca common reporting standard crs.

Income tax act 1967. Akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 atau akta cukai pendapatan 1967 salinan akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 salinan di lawati. 7 ita 1967 residence individuals.

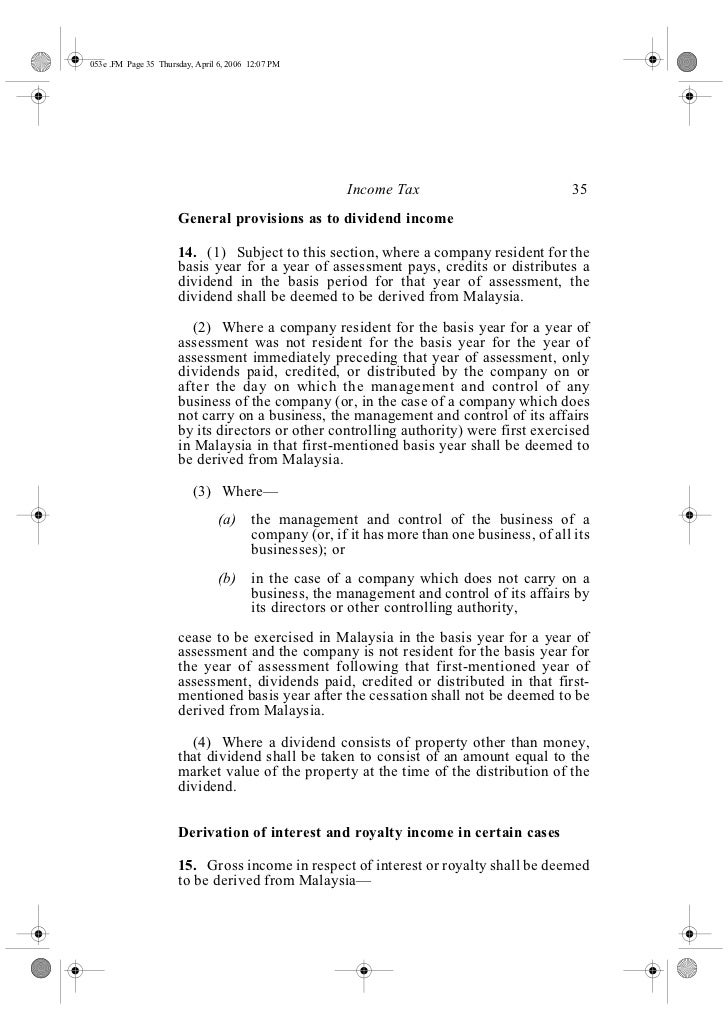

Enactments in force for any year to apply to tax for succeeding year. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax. Structure edit the income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments.

A he is in malaysia in that basis year for a period or periods amounting in all to one hundred and eighty two days or more.