Malaysian Income Tax Calculator For Foreigners

When filing income tax please fill in form b1 income tax return for residents.

Malaysian income tax calculator for foreigners. Foreign income earned is not taxable. If you make a. To file your income tax the expatriate will need to obtain a tax number from the inland revenue board of malaysia irb.

If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. Introduced tax resident toggle for local and foreigner tax residents to omit epf contributions. Here are the differences.

Update of pcb calculator for ya2017. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582. Introduced socso calculation and removal of rm2000 special tax relief.

As a general rule anyone earning a salary in malaysia is required to pay income tax unless they fall into one of the exceptions. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Normally companies will obtain the income tax numbers for their foreign workers.

This guide will focus on income tax for individuals. For the most part foreigners working in malaysia are divided into two categories. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available.

However if the company has failed to obtain one the worker can register for an income tax number at the nearest irb office. That means that your net pay will be rm 59 418 per year or rm 4 952 per month. Malaysia adopts a territorial approach to income tax.

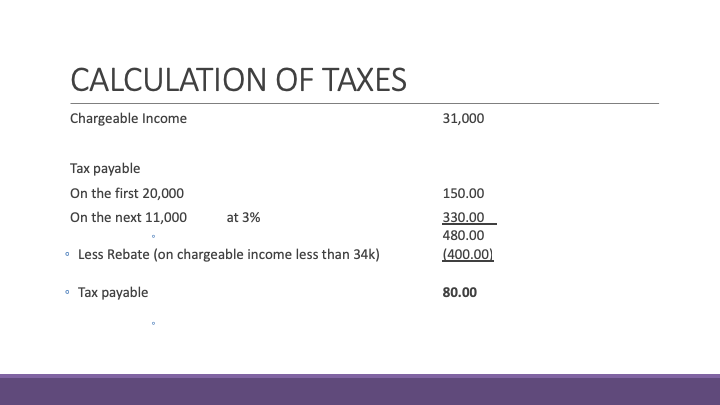

Pcb epf socso eis and income tax calculator. Calculation of yearly income tax for 2019. Salary calculator malaysia.

Tax implications at a glance period of stay inclusive of work in singapore tax residency status tax implications at least 183 days in a year. This marginal tax rate means that your immediate additional income will be taxed at this rate. It s important to know that all tax residents and non residents of malaysia this includes every person in the country regardless of nationality will be taxed on all income earned within malaysia if they are liable.

The provided calculations and explanations are estimates and do not constitute financial tax or legal advice. You are considered a resident. Any foreigners who have been working in malaysia for more than 182 days are eligible to be taxed under normal malaysian income tax laws and rates just like malaysian nationals.

This worldwide tax brackets calculator can be used by tax attorneys accountants or cpas and individuals or businesses to provide estimates and comparison of tax rates across different jurisdictions. Your average tax rate is 15 12 and your marginal tax rate is 22 50. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia.

Introduced bonus feature as an additional income source to calculate pcb. Resident stays in malaysia for more than 182 days in a calendar year.