Medical Expenses For Parents Tax Relief Malaysia

The claim must be supported by a certified medical practitioner registered with the malaysian medical council that the medical conditions of the parents require medical treatment or special needs or carer.

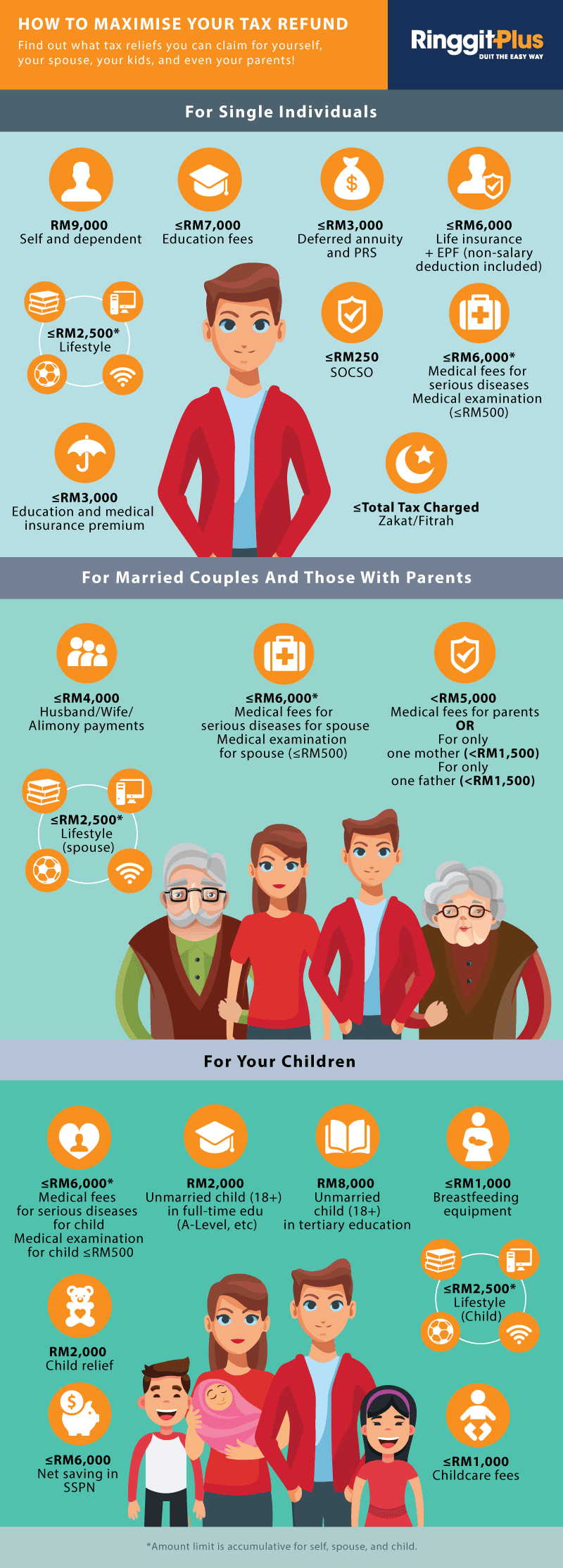

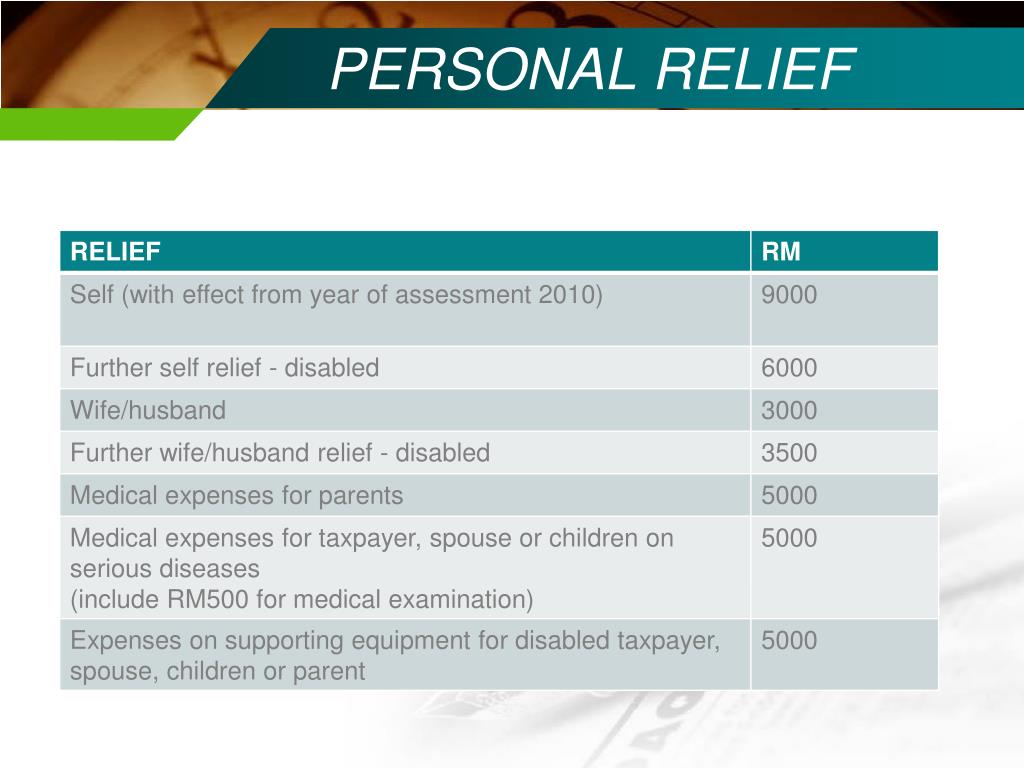

Medical expenses for parents tax relief malaysia. There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. ü subject to criteria under section 46 1 o income tax act 1967.

A medical treatment expenditures for parents who are diagnosed with diseases or physical mental disabilities and healthcare services that are supported by receipts issued by medical practitioners who are registered under the malaysian medical council mmc pharmacies or licensed drug stores. Medical expenses for parents. Under the penjana recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from rm2 000 to rm3 000 however this is not applicable when you file this year as it only applies to the year of assessment.

Or deduction for parents. With this tax deduction the taxpayers will enjoy lower taxable income and consequently lower income tax payments. The medical treatment and care services are provided in malaysia.

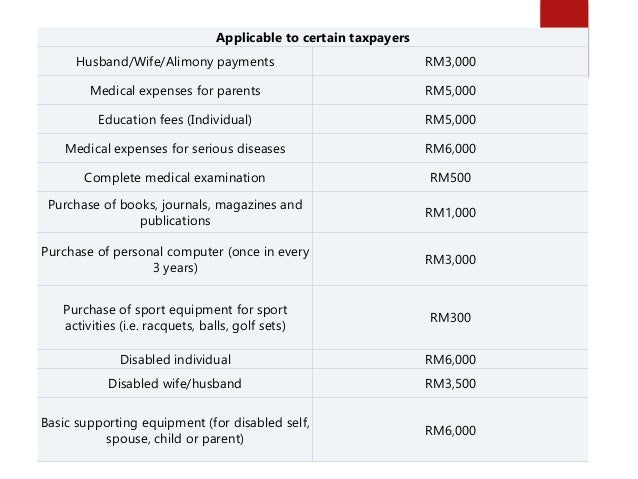

6 000 limited disabled individual. This relief is applicable for year assessment 2013 and 2015 only. Medical treatment special needs and care expenses for parents.

Tax relief year 2019. Medical expenses for parents income tax relief medical expenses for parents section 46 1 c of income tax act 1967 malaysian taxpayers must aware that medical fee paid for parents medical treatment is tax deductible. ü did not claim medical treatment special needs and care expenses for parents in the same year of assessment.

The parents are aged 60 years and above. The parents are the legitimate natural parents and foster parents in accordance with the law subject to a maximum of two persons. Parent limited 1 500 for only one mother limited 1 500 for only one father.

The parents shall be resident in malaysia. 5 000 limited 3. Amount rm self and dependent.

3000 limited basic supporting equipment for disabled self spouse child or parent. Amount rm 1. The parents are tax residents in malaysia in the current year of assessment.

Tax relief of up to a maximum of rm5 000 is available in respect of medical expenses expended by an individual for his parents provided that the claim is evidenced by a medical practitioner s receipt to certify that the treatment was provided for your parents.